SHAHEEN STATEMENT ON REAUTHORIZATION OF EXPORT-IMPORT BANK

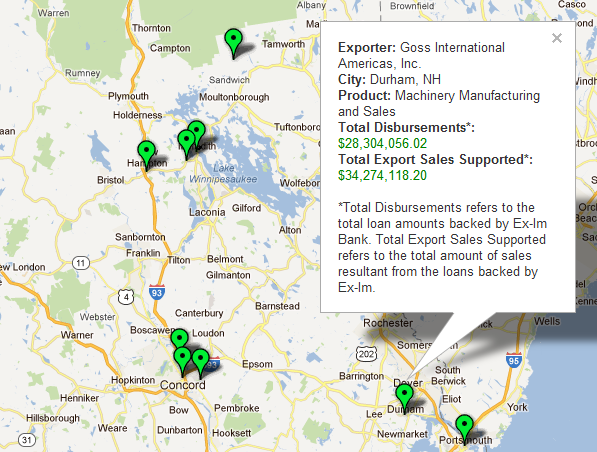

This interactive map shows which New Hampshire businesses have been able to increase their exports through the assistance of the Export-Import Bank: http://www.shaheen.senate.gov/export-import/

(Washington, D.C.) – U.S. Senator Jeanne Shaheen (D-NH) released the following statement after a bill to reauthorize the Export-Import bank passed in the Senate in a 78-20 vote.

“The Export-Import Bank strengthens our economy by helping American companies sell their goods abroad, expand their business and create jobs,” Shaheen said. “The Export-Import Bank has directly supported $255 million in export sales from New Hampshire over the past five years. It is bipartisan, it reduces the deficit and it allows U.S. companies to remain competitive in the global market. I’m glad the Senate was able to come together in a bipartisan way so we can now send this legislation to the President. ”

The bill now heads to the President for his signature.

The Export-Import Bank is the official export credit agency of the United States. It provides direct loans and loan guarantees to foreign buyers of U.S. made goods, which is critical for buyers of large products such as airplanes. It also provides working capital loans to small businesses that are exporting, and provides insurance for exporters in case a foreign buyer fails to pay. In all these cases, the bank is filling gaps in the private market. It is an important tool for U.S. companies seeking to compete with foreign firms, which often get aggressive trade financing support from their national governments.

In 2011 alone, the Export-Import Bank supported an estimated 288,000 American jobs at more than 3,600 U.S. companies and facilitated $41 billion in exports. The bank pays for itself through the fees it collects and is projected to reduce the federal deficit by $900 million over five years, according to the non-partisan Congressional Budget Office.

The Export-Import Bank’s impact extends beyond the companies it has supported directly. New Hampshire Ball Bearings, which wrote Shaheen’s office in March asking for help in reauthorizing the bank, is not a direct client of the bank. However, it sells 80 percent of its products to the aerospace industry, which is heavily reliant on the export financing that the bank provides. Shaheen went to New Hampshire Ball Bearings in Laconia, as well as Skelley Medical in Hollis, to discuss the importance of the Bank this month.

She cosponsored a bipartisan measure in the Senate to reauthorize the bank for four years. Reauthorization is supported by hundreds of U.S. companies, the U.S. Chamber of Commerce, the National Association of Manufacturers and the Business Roundtable. It has enjoyed broad bipartisan support in past reauthorizations, passing without objection in both the House and Senate in 2006.

A member of the Senate Committee on Small Business, Shaheen has consistently worked to aid small companies in reaching foreign customers. Last year she hosted a Small Business Committee field hearing in Manchester with U.S. Senator Kelly Ayotte (R-NH) to examine ways to help small businesses export. Shaheen also held roundtable discussions with New Hampshire small business owners on the federal resources available to help small businesses export with Export-Import Bank Chairman and President Fred Hochberg.

Press Office, (202) 224-5553